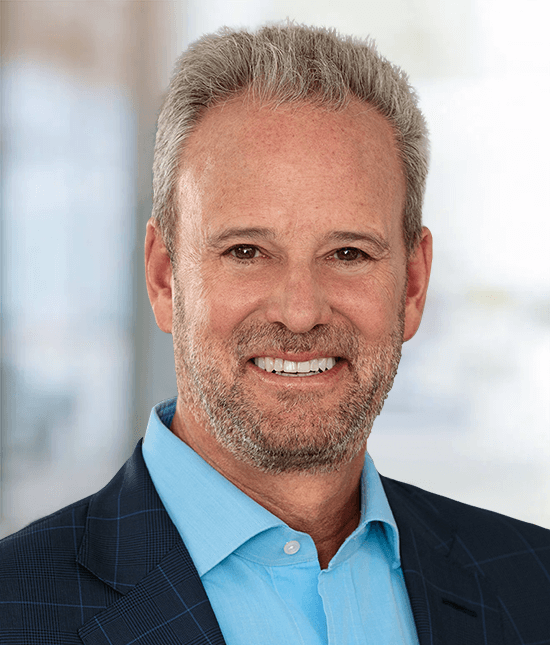

Gerry Cardinale is the Founder, Managing Partner and Chief Investment Officer of RedBird Capital Partners.

RedBird manages $12 billion of equity on behalf of a select group of blue-chip institutional and family office investors. The Firm’s investment portfolio includes many of the world’s most iconic entrepreneurs, properties and brands across the sports, media and entertainment industries. Notable investments include:

- Fenway Sports Group (Boston Red Sox, Liverpool FC, Pittsburgh Penguins, New England Sports Network);

- Skydance Media (Larry and David Ellison) and its pending acquisition of Paramount and CBS;

- Artists Equity (Ben Affleck and Matt Damon);

- European football’s A.C. Milan, the second most winning Champions League team in history;

- Yankees Entertainment & Sports (“YES”) Network (New York Yankees and Amazon); and

- United Football League (UFL) (Dwayne Johnson, Fox, Disney)

RedBird has also been an active investor and company builder in Financial Services, having invested over $1.5 billion primarily across Insurance & Insurance Distribution and Asset & Wealth Management. Notable investments include:

- Aquarian, a diversified life and annuity carrier and asset management platform with ~$20 billion in assets that has grown 20x since RedBird invested in 2020;

- Constellation, a managing general agent (“MGA”) insurance distribution platform that RedBird scaled to a top 10 player in the industry in under 2 years before exiting to Truist in July 2021;

- Arax, one of the fastest growing wealth management platforms in the US that RedBird has scaled to ~$27 billion of AUM in less than 2 years;

- Bishop Street, a rapidly growing MGA insurance distribution platform that RedBird has scaled to a top 20 US MGA with ~$500 million of GWP in less than 2 years; and

- Obra, a diversified alternative credit manager with $5 billion+ of AUM

Prior to founding RedBird in 2014, Gerry spent 20 years at Goldman Sachs where he was a Partner of the firm and a senior leader of the Merchant Bank’s private equity investing business. During his tenure, Gerry worked with entrepreneurs and family business owners to create several successful multi-billion-dollar companies.

Gerry is a Trustee of the Mount Sinai Health System in New York City and a Trustee of the US Rowing Foundation. Gerry’s philanthropy has been dedicated to higher education, with focused commitments to Harvard University, Phillips Academy Andover and the Rhodes Scholarships. In addition, Gerry has made substantial commitments to international economic development and women’s empowerment through Matt Damon’s Water.org, an international nonprofit organization that helps low-income populations get access to safe water and improved sanitation through affordable financing.

Gerry received an Honors BA from Harvard University where he graduated Magna Cum Laude and an M.Phil in Politics and Political Theory from Oxford University where he was a Rhodes Scholar.